All Categories

Featured

Table of Contents

Life insurance is more than just a policy; it’s a vital tool for protecting your loved ones and securing their financial future. Whether you’re looking for term life insurance to cover immediate needs or whole life insurance for lifelong security, the right policy offers peace of mind during life’s uncertainties. cheap life insurance near me with brokers. Affordable options include universal life insurance, which combines flexibility with investment opportunities, or final expense insurance, designed to cover funeral costs and related expenses

For homeowners, mortgage protection life insurance provides added security, ensuring your family can keep their home in case of unexpected events. Accidental death insurance is another valuable option, offering coverage tailored to specific circumstances. Many policies now come with living benefits, allowing policyholders to access funds in cases of critical illness or other emergencies, adding another layer of financial support.

Life insurance adapts to your goals, whether you’re planning for retirement, saving for college, or ensuring your business is protected with key person insurance. Speak with a licensed insurance agent today to discover flexible options that align with your family or business needs. Request a free quote now and take the first step toward a secure tomorrow.

There is no payment if the plan ends before your death or you live beyond the plan term. You might be able to renew a term policy at expiry, yet the premiums will be recalculated based on your age at the time of revival. Term life insurance policy is generally the least costly life insurance policy available due to the fact that it uses a death advantage for a limited time and doesn't have a money worth component like long-term insurance policy.

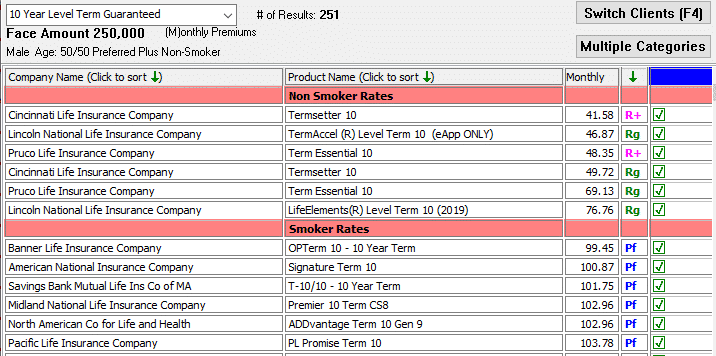

At age 50, the costs would certainly climb to $67 a month. Term Life Insurance coverage Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and ladies in outstanding health and wellness. On the other hand, here's a look at prices for a $100,000 entire life policy (which is a type of long-term policy, implying it lasts your lifetime and consists of money worth).

The reduced threat is one aspect that permits insurers to charge reduced costs. Rate of interest, the financials of the insurer, and state guidelines can additionally influence costs. As a whole, firms typically offer far better rates at the "breakpoint" insurance coverage degrees of $100,000, $250,000, $500,000, and $1,000,000. When you take into consideration the quantity of protection you can get for your costs dollars, term life insurance policy tends to be the least pricey life insurance coverage.

He buys a 10-year, $500,000 term life insurance coverage policy with a premium of $50 per month. If George passes away within the 10-year term, the policy will pay George's recipient $500,000.

If George is diagnosed with a terminal disease during the very first policy term, he most likely will not be qualified to renew the plan when it expires. Some policies supply guaranteed re-insurability (without proof of insurability), but such functions come at a higher cost. There are a number of kinds of term life insurance coverage.

A lot of term life insurance has a level costs, and it's the type we've been referring to in many of this write-up.

Preferred Direct Term Life Insurance Meaning

Term life insurance policy is eye-catching to youths with children. Moms and dads can obtain significant protection for an affordable, and if the insured dies while the policy holds, the family members can depend on the survivor benefit to change lost revenue. These plans are likewise fit for people with growing families.

Term life policies are perfect for individuals that desire considerable protection at a reduced price. People who have entire life insurance policy pay more in premiums for less coverage but have the safety of understanding they are secured for life.

The conversion biker ought to enable you to transform to any type of irreversible plan the insurance provider uses without constraints. The key functions of the rider are keeping the original wellness rating of the term policy upon conversion (also if you later on have wellness concerns or become uninsurable) and choosing when and exactly how much of the coverage to transform.

Of training course, total premiums will certainly boost dramatically because whole life insurance policy is a lot more expensive than term life insurance policy. Medical conditions that create during the term life duration can not create costs to be boosted.

Whole life insurance policy comes with considerably higher regular monthly premiums. It is indicated to provide protection for as long as you live.

Tax-Free Term 100 Life Insurance

Insurance companies established a maximum age limit for term life insurance coverage plans. The costs likewise increases with age, so an individual aged 60 or 70 will certainly pay substantially even more than a person decades younger.

Term life is somewhat comparable to car insurance. It's statistically unlikely that you'll need it, and the costs are money away if you don't. Yet if the most awful takes place, your household will get the advantages.

One of the most popular type is currently 20-year term. Many business will not offer term insurance policy to an applicant for a term that ends past his or her 80th birthday. If a policy is "renewable," that means it proceeds active for an additional term or terms, as much as a defined age, also if the wellness of the insured (or other elements) would certainly cause him or her to be turned down if she or he used for a brand-new life insurance coverage plan.

Premiums for 5-year sustainable term can be degree for 5 years, after that to a new price mirroring the brand-new age of the guaranteed, and so on every 5 years. Some longer term policies will guarantee that the premium will not enhance during the term; others don't make that guarantee, allowing the insurance policy firm to increase the rate during the plan's term.

This means that the policy's proprietor has the right to change it into a permanent sort of life insurance without extra proof of insurability. In a lot of sorts of term insurance policy, consisting of property owners and auto insurance coverage, if you haven't had a claim under the plan by the time it ends, you obtain no refund of the premium.

High-Quality Annual Renewable Term Life Insurance

Some term life insurance policy customers have been miserable at this outcome, so some insurance providers have actually produced term life with a "return of premium" function. term life insurance with accelerated death benefit. The costs for the insurance policy with this attribute are commonly significantly more than for plans without it, and they generally call for that you maintain the plan in pressure to its term otherwise you forfeit the return of costs advantage

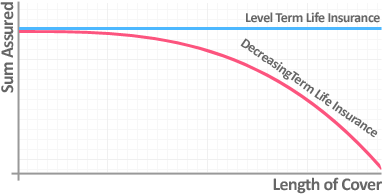

Degree term life insurance coverage costs and death benefits remain constant throughout the policy term. Level term life insurance coverage is typically extra inexpensive as it does not develop cash value.

The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

While the names usually are made use of mutually, degree term insurance coverage has some vital differences: the premium and survivor benefit stay the exact same throughout of coverage. Degree term is a life insurance policy plan where the life insurance policy premium and fatality benefit remain the exact same for the period of coverage.

Table of Contents

Latest Posts

Highlighting Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining Fixed Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing th

Final Expense Florida

How To Sell Burial Insurance

More

Latest Posts

Final Expense Florida

How To Sell Burial Insurance