All Categories

Featured

Table of Contents

The kid cyclist is bought with the notion that your kid's funeral expenditures will be totally covered. Child insurance bikers have a death advantage that ranges from $5,000 to $25,000. When you're grieving this loss, the last point you require is your debt adding complications. To purchase this rider, your youngster has their very own standards to fulfill.

Your youngster must likewise be between the ages of 15 days to 18 years of ages. They can be covered under this plan until they are 25 years of ages. Note that this plan just covers your youngsters not your grandchildren. Last expenditure insurance coverage benefits don't end when you sign up with a plan.

Bikers can be found in various kinds and provide their very own advantages and rewards for signing up with. Riders deserve looking right into if these extra choices relate to you. Bikers consist of: Accelerated fatality benefitChild riderLong-term careTerm conversionWaiver of costs The increased survivor benefit is for those that are terminally ill. If you are seriously sick and, depending upon your certain policy, figured out to live no more than six months to two years.

The Accelerated Survivor Benefit (most of the times) is not strained as revenue. The drawback is that it's mosting likely to decrease the death benefit for your beneficiaries. Getting this additionally needs proof that you will certainly not live past six months to 2 years. The kid motorcyclist is acquired with the concept that your child's funeral service costs will certainly be completely covered.

Insurance coverage can last up until the child transforms 25. The lasting treatment cyclist is comparable in concept to the sped up death advantage.

This is a living advantage. It can be borrowed against, which is extremely beneficial since long-lasting care is a substantial expenditure to cover.

Funeral Insurance Over 80 Years Of Age

The motivation behind this is that you can make the button without undergoing a medical test. burial policy prices. And given that you will no longer get on the term plan, this also indicates that you no longer need to fret about outliving your plan and shedding out on your fatality benefit

The exact quantity depends upon different aspects, such as: Older people generally face higher premiums due to enhanced health and wellness threats. Those with existing health and wellness problems might come across greater costs or constraints on protection. Greater coverage quantities will naturally lead to higher premiums. Remember, policies usually top out around $40,000.

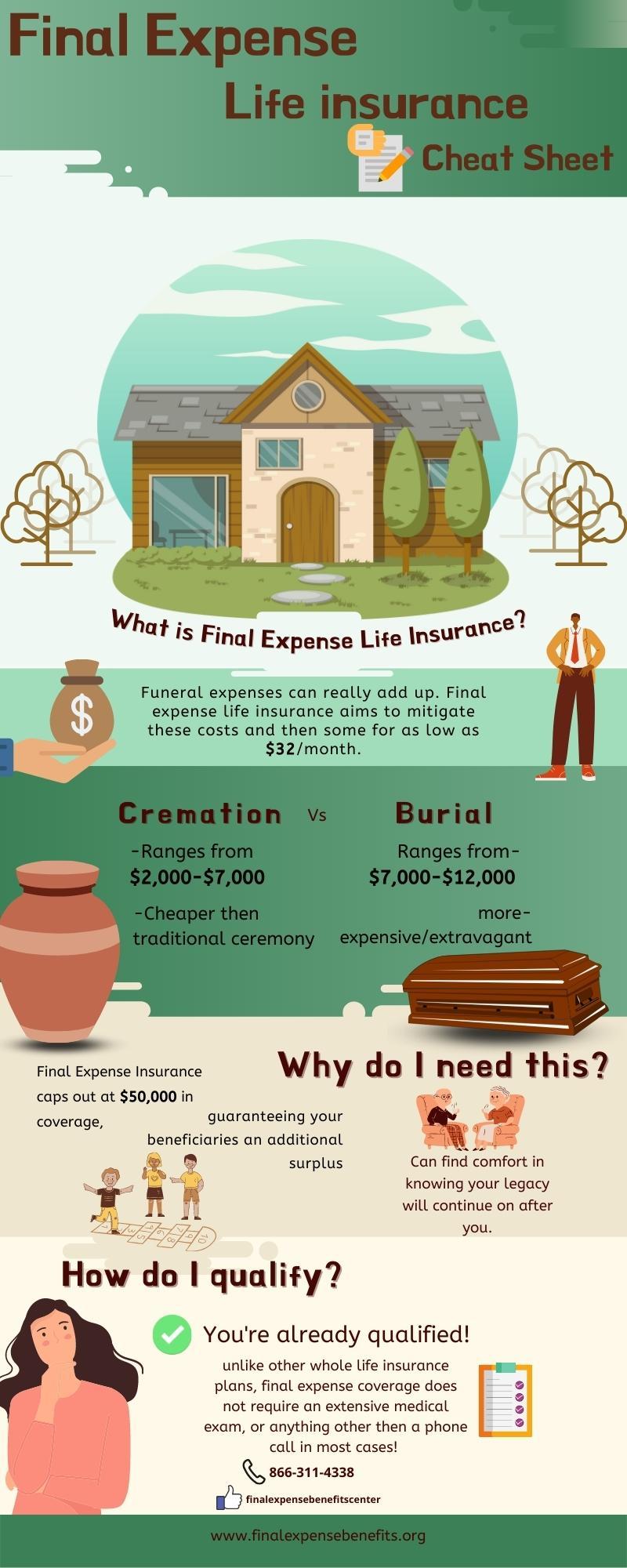

Take into consideration the month-to-month premium payments, however additionally the assurance and monetary security it provides your household. For lots of, the reassurance that their liked ones will certainly not be strained with financial hardship during a challenging time makes last expense insurance a beneficial financial investment. There are 2 types of final expenditure insurance coverage:: This type is best for individuals in relatively great health and wellness who are looking for a way to cover end-of-life expenses.

Insurance coverage amounts for simplified concern plans commonly rise to $40,000.: This type is best for people whose age or health and wellness stops them from acquiring other kinds of life insurance policy protection. There are no wellness demands in all with guaranteed issue plans, so anyone who fulfills the age demands can generally qualify.

Mutual Of Omaha Final Expense Insurance

Below are a few of the aspects you need to take right into factor to consider: Review the application process for different policies. Some might require you to address health and wellness questions, while others provide guaranteed problem alternatives. Make certain the carrier that you select offers the amount of insurance coverage that you're searching for. Consider the repayment choices available from each service provider such as monthly, quarterly, or annual costs.

Table of Contents

Latest Posts

Highlighting Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining Fixed Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing th

Final Expense Florida

How To Sell Burial Insurance

More

Latest Posts

Final Expense Florida

How To Sell Burial Insurance