All Categories

Featured

Table of Contents

Navigating life insurance options can be overwhelming, especially with so many policies available. This is where working with an experienced insurance broker or agent makes all the difference. Unlike insurance agents tied to a single provider, brokers offer access to multiple life insurance options, helping you find the most suitable policy for your needs - life insurance for estate planning with brokers. Whether it’s term life insurance for temporary coverage, whole life insurance for lifelong protection, or universal life for long-term growth, an insurance broker evaluates your unique goals and compares providers to secure the best coverage at competitive rates

For families, policies like final expense insurance, mortgage protection, and accidental death coverage offer tailored solutions to protect loved ones. Business owners can also benefit from key person insurance, ensuring continuity in the event of an unforeseen loss. With life insurance policies offering living benefits or instant coverage, brokers simplify the decision-making process and ensure your financial priorities are met.

By choosing the right insurance broker, you gain expert guidance, access to personalized recommendations, and the confidence of knowing your family or business is secure. Contact an insurance broker today to explore tailored life insurance options and secure peace of mind for the future.

They usually offer an amount of coverage for a lot less than permanent sorts of life insurance policy. Like any type of plan, term life insurance has benefits and disadvantages depending upon what will certainly function best for you. The advantages of term life include affordability and the capability to tailor your term size and protection quantity based upon your needs.

Relying on the kind of plan, term life can provide fixed premiums for the whole term or life insurance policy on level terms. The death advantages can be repaired. Since it's a cost effective life insurance coverage product and the settlements can remain the exact same, term life insurance coverage policies are preferred with youths just beginning, households and people that desire protection for a certain amount of time.

What Is Level Term Life Insurance

Rates reflect policies in the Preferred And also Price Class concerns by American General 5 Stars My representative was extremely experienced and useful in the process. July 13, 2023 5 Stars I was satisfied that all my demands were satisfied without delay and skillfully by all the representatives I spoke to.

All documentation was electronically completed with accessibility to downloading and install for individual documents upkeep. June 19, 2023 The endorsements/testimonials offered should not be taken as a referral to acquire, or a sign of the worth of any type of service or product. The reviews are real Corebridge Direct clients that are not associated with Corebridge Direct and were not given compensation.

2 Cost of insurance rates are determined utilizing methodologies that vary by company. It's essential to look at all elements when evaluating the overall competitiveness of rates and the worth of life insurance policy coverage.

Top Level Term Life Insurance

Like most team insurance coverage policies, insurance coverage plans provided by MetLife include particular exclusions, exceptions, waiting durations, reductions, constraints and terms for maintaining them in pressure (level term life insurance). Please call your advantages manager or MetLife for prices and complete information.

Essentially, there are two sorts of life insurance policy plans - either term or long-term plans or some combination of both. Life insurance providers offer different forms of term strategies and standard life plans in addition to "passion sensitive" products which have actually become extra prevalent considering that the 1980's.

Term insurance policy supplies protection for a specified time period. This period could be as short as one year or give insurance coverage for a details variety of years such as 5, 10, 20 years or to a specified age such as 80 or in many cases up to the earliest age in the life insurance policy mortality.

What Is Decreasing Term Life Insurance

Currently term insurance coverage prices are very competitive and among the most affordable traditionally knowledgeable. It must be kept in mind that it is an extensively held idea that term insurance policy is the least pricey pure life insurance protection available. One requires to examine the policy terms meticulously to decide which term life options appropriate to meet your certain scenarios.

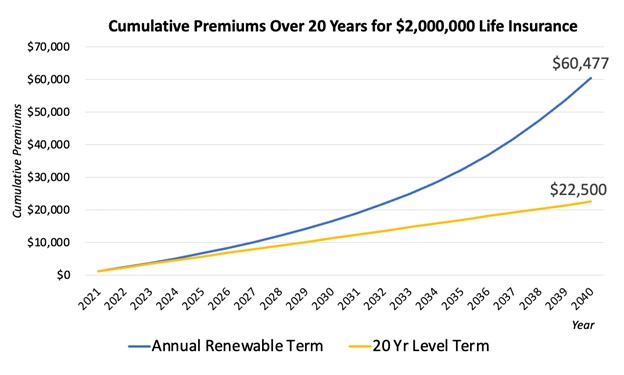

With each new term the costs is enhanced. The right to restore the policy without proof of insurability is an important advantage to you. Otherwise, the threat you take is that your health may degrade and you may be not able to acquire a policy at the very same rates and even in any way, leaving you and your beneficiaries without insurance coverage.

You need to exercise this alternative throughout the conversion duration. The length of the conversion duration will differ relying on the sort of term plan acquired. If you convert within the recommended period, you are not required to give any info concerning your health. The costs price you pay on conversion is generally based on your "current attained age", which is your age on the conversion date.

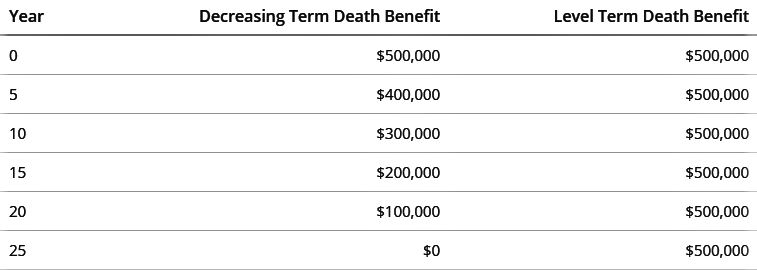

Under a degree term plan the face amount of the plan remains the same for the whole duration. With lowering term the face amount decreases over the duration. The costs remains the exact same annually. Often such plans are offered as mortgage protection with the quantity of insurance policy lowering as the equilibrium of the home loan lowers.

Commonly, insurance companies have actually not can transform costs after the plan is offered (term life insurance with accelerated death benefit). Because such plans might continue for several years, insurers need to make use of conventional death, rate of interest and cost rate quotes in the premium calculation. Adjustable costs insurance policy, however, enables insurance firms to provide insurance policy at reduced "existing" premiums based upon less conservative assumptions with the right to alter these premiums in the future

Long-Term Which Of These Is Not An Advantage Of Term Life Insurance

While term insurance is developed to offer defense for a specified amount of time, irreversible insurance coverage is created to give insurance coverage for your entire lifetime. To maintain the premium price level, the costs at the younger ages surpasses the real expense of security. This added costs develops a get (money worth) which assists spend for the plan in later years as the cost of protection increases over the premium.

Under some policies, premiums are called for to be spent for an established variety of years. Under various other plans, premiums are paid throughout the insurance holder's life time. The insurance company spends the excess costs bucks This sort of plan, which is in some cases called money value life insurance policy, generates a cost savings component. Cash money values are crucial to a long-term life insurance policy plan.

Tax-Free What Is Level Term Life Insurance

In some cases, there is no relationship in between the dimension of the money value and the costs paid. It is the cash money worth of the plan that can be accessed while the policyholder is active. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the present table used in calculating minimal nonforfeiture worths and plan gets for common life insurance policy plans.

Several permanent plans will contain arrangements, which define these tax obligation needs. There are two fundamental groups of permanent insurance policy, typical and interest-sensitive, each with a variety of variations. Additionally, each group is normally available in either fixed-dollar or variable form. Conventional whole life plans are based upon long-term quotes of expense, passion and mortality.

If these price quotes transform in later years, the company will certainly change the costs appropriately yet never over the maximum ensured costs specified in the policy. An economatic entire life plan attends to a basic quantity of getting involved whole life insurance with an extra supplementary protection provided via using rewards.

Because the premiums are paid over a shorter period of time, the premium repayments will certainly be higher than under the entire life plan. Single premium entire life is minimal repayment life where one large exceptional settlement is made. The plan is fully paid up and no further premiums are called for.

Table of Contents

Latest Posts

Highlighting Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining Fixed Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing th

Final Expense Florida

How To Sell Burial Insurance

More

Latest Posts

Final Expense Florida

How To Sell Burial Insurance