All Categories

Featured

Table of Contents

- – What is the Difference with 10-year Level Term...

- – What Is Term Life Insurance With Accidental De...

- – An Introduction to 10-year Level Term Life In...

- – What is What Does Level Term Life Insurance M...

- – Is What Is Level Term Life Insurance the Rig...

- – How Does Level Benefit Term Life Insurance H...

If George is diagnosed with a terminal illness throughout the first policy term, he probably will not be qualified to restore the policy when it runs out. Some policies use guaranteed re-insurability (without proof of insurability), but such functions come at a greater expense. There are several sorts of term life insurance policy.

Usually, most companies offer terms ranging from 10 to 30 years, although a couple of offer 35- and 40-year terms. Level-premium insurance policy has a fixed regular monthly settlement for the life of the plan. The majority of term life insurance has a level premium, and it's the type we have actually been referring to in a lot of this short article.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (life insurance for retirement planning with brokers). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

Term life insurance policy is appealing to youngsters with children. Moms and dads can get substantial insurance coverage for an affordable, and if the insured passes away while the policy is in impact, the family can depend on the survivor benefit to replace lost revenue. These plans are likewise fit for individuals with expanding family members.

What is the Difference with 10-year Level Term Life Insurance?

Term life plans are optimal for people that want substantial coverage at a low expense. People that own entire life insurance policy pay a lot more in costs for much less coverage however have the safety and security of understanding they are secured for life.

The conversion biker ought to allow you to transform to any kind of irreversible policy the insurer offers without limitations. The main attributes of the motorcyclist are keeping the original health and wellness ranking of the term policy upon conversion (even if you later on have health issues or come to be uninsurable) and determining when and how much of the protection to transform.

Naturally, overall costs will increase significantly given that whole life insurance policy is more expensive than term life insurance. The advantage is the assured approval without a medical examination. Medical problems that create during the term life duration can not trigger costs to be enhanced. The firm might need limited or full underwriting if you desire to add extra motorcyclists to the brand-new plan, such as a lasting treatment motorcyclist.

What Is Term Life Insurance With Accidental Death Benefit? The Complete Overview?

Term life insurance policy is a fairly economical means to supply a swelling amount to your dependents if something happens to you. It can be an excellent option if you are young and healthy and balanced and support a family. Whole life insurance policy features significantly greater monthly costs. It is implied to supply insurance coverage for as lengthy as you live.

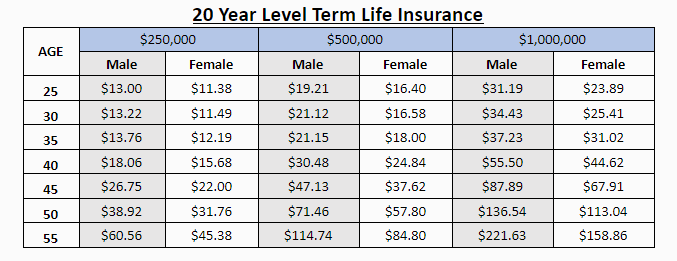

Insurance firms established a maximum age restriction for term life insurance coverage policies. The costs additionally rises with age, so a person matured 60 or 70 will certainly pay significantly more than someone years younger.

Term life is somewhat comparable to vehicle insurance. It's statistically not likely that you'll require it, and the costs are money down the tubes if you do not. However if the worst happens, your household will get the advantages (Annual renewable term life insurance).

An Introduction to 10-year Level Term Life Insurance

For the many component, there are 2 types of life insurance policy plans - either term or irreversible strategies or some combination of the two. Life insurance providers offer different types of term plans and standard life policies as well as "passion delicate" products which have actually ended up being extra common given that the 1980's.

Term insurance coverage offers defense for a given time period. This period can be as brief as one year or provide protection for a details variety of years such as 5, 10, two decades or to a specified age such as 80 or in some cases up to the oldest age in the life insurance policy mortality.

What is What Does Level Term Life Insurance Mean? Key Points to Consider?

Currently term insurance prices are really competitive and among the lowest historically experienced. It ought to be noted that it is an extensively held idea that term insurance is the least costly pure life insurance policy coverage offered. One needs to assess the policy terms carefully to decide which term life choices appropriate to satisfy your certain conditions.

With each new term the costs is boosted. The right to restore the policy without evidence of insurability is an essential advantage to you. Otherwise, the danger you take is that your health and wellness might weaken and you may be unable to get a plan at the exact same prices or perhaps at all, leaving you and your recipients without coverage.

You should exercise this alternative during the conversion period. The size of the conversion duration will certainly vary depending on the kind of term policy bought. If you transform within the recommended duration, you are not required to give any kind of information about your health and wellness. The costs rate you pay on conversion is generally based upon your "existing acquired age", which is your age on the conversion day.

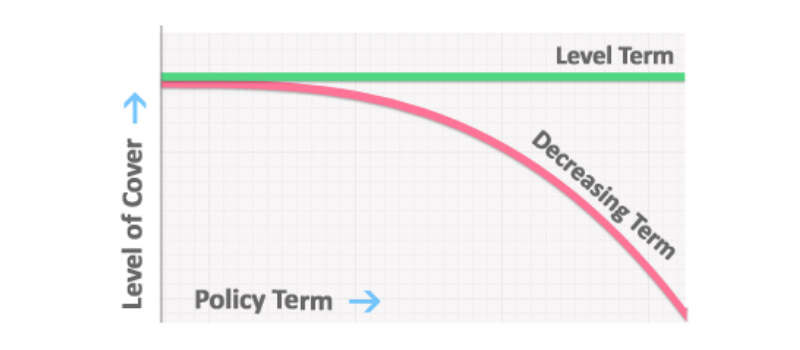

Under a level term policy the face quantity of the policy stays the very same for the entire period. Frequently such plans are marketed as home loan protection with the quantity of insurance coverage reducing as the balance of the mortgage reduces.

Typically, insurance companies have not deserved to alter premiums after the policy is offered. Given that such plans may proceed for several years, insurance companies must make use of conservative mortality, passion and expense price price quotes in the costs calculation. Flexible premium insurance, nevertheless, enables insurance firms to provide insurance policy at reduced "existing" costs based upon less conservative assumptions with the right to change these premiums in the future.

Is What Is Level Term Life Insurance the Right Fit for You?

While term insurance coverage is designed to offer defense for a defined period, long-term insurance coverage is designed to give coverage for your entire life time. To keep the premium price level, the costs at the more youthful ages goes beyond the actual cost of protection. This extra premium develops a reserve (cash money worth) which aids spend for the policy in later years as the price of defense surges over the premium.

Under some policies, premiums are required to be spent for a set variety of years (Guaranteed level term life insurance). Under various other plans, costs are paid throughout the insurance policy holder's lifetime. The insurance policy business invests the excess premium bucks This type of policy, which is often called cash value life insurance policy, creates a savings component. Cash worths are vital to an irreversible life insurance coverage policy.

In some cases, there is no relationship between the size of the money value and the costs paid. It is the cash money value of the plan that can be accessed while the insurance holder is to life. The Commissioners 1980 Criterion Ordinary Death Table (CSO) is the present table used in calculating minimal nonforfeiture worths and policy reserves for common life insurance policy plans.

How Does Level Benefit Term Life Insurance Help You?

Numerous permanent plans will certainly contain stipulations, which specify these tax demands. Conventional whole life plans are based upon long-term price quotes of expense, interest and death.

Table of Contents

- – What is the Difference with 10-year Level Term...

- – What Is Term Life Insurance With Accidental De...

- – An Introduction to 10-year Level Term Life In...

- – What is What Does Level Term Life Insurance M...

- – Is What Is Level Term Life Insurance the Rig...

- – How Does Level Benefit Term Life Insurance H...

Latest Posts

Highlighting Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining Fixed Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing th

Final Expense Florida

How To Sell Burial Insurance

More

Latest Posts

Final Expense Florida

How To Sell Burial Insurance