All Categories

Featured

Table of Contents

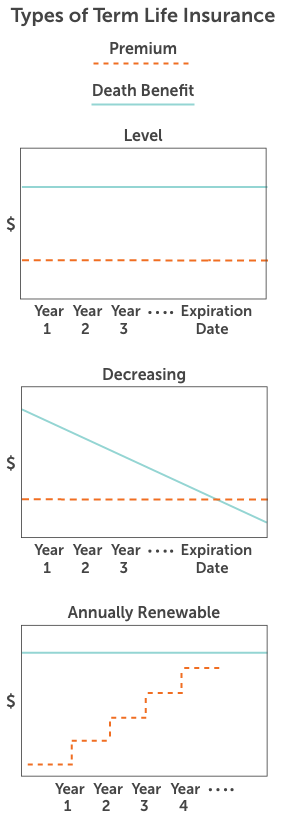

Term Life Insurance Policy is a kind of life insurance policy policy that covers the insurance policy holder for a particular amount of time, which is called the term. The term sizes vary according to what the individual selects. Terms usually range from 10 to thirty years and rise in 5-year increments, offering degree term insurance.

They usually provide a quantity of insurance coverage for a lot less than irreversible sorts of life insurance policy. Like any type of policy, term life insurance coverage has benefits and downsides depending on what will certainly work best for you. The benefits of term life include affordability and the capability to personalize your term size and coverage amount based upon your needs.

Depending on the kind of policy, term life can offer fixed costs for the whole term or life insurance on level terms. The fatality advantages can be dealt with.

You need to consult your tax advisors for your details accurate situation. *** Fees mirror plans in the Preferred And also Rate Course problems by American General 5 Stars My agent was really educated and handy at the same time. No stress to purchase and the process was quick. July 13, 2023 5 Stars I was satisfied that all my demands were satisfied immediately and professionally by all the reps I spoke to.

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. instant online life insurance quotes with agents. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

What Are the Benefits of Annual Renewable Term Life Insurance?

All documentation was electronically completed with access to downloading and install for individual file maintenance. June 19, 2023 The endorsements/testimonials offered ought to not be understood as a referral to purchase, or an indication of the value of any product and services. The testimonies are actual Corebridge Direct customers who are not affiliated with Corebridge Direct and were not supplied compensation.

There are numerous types of term life insurance policy plans. Rather than covering you for your entire life expectancy like whole life or global life plans, term life insurance policy only covers you for a designated amount of time. Policy terms normally range from 10 to three decades, although shorter and longer terms may be readily available.

If you desire to keep insurance coverage, a life insurance firm might offer you the alternative to renew the plan for one more term. If you added a return of premium motorcyclist to your policy, you would certainly obtain some or all of the cash you paid in premiums if you have outlasted your term.

Degree term life insurance coverage might be the very best option for those who desire protection for a collection amount of time and desire their costs to continue to be stable over the term. This might put on buyers concerned regarding the price of life insurance coverage and those that do not desire to change their fatality benefit.

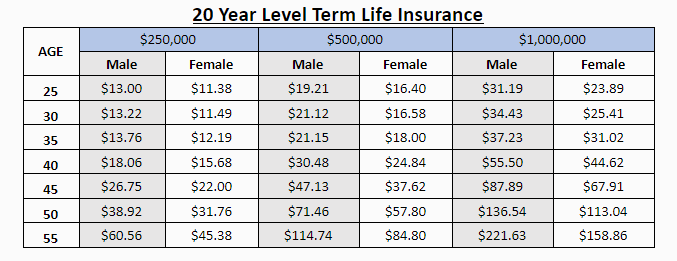

That is since term plans are not ensured to pay, while permanent plans are, gave all premiums are paid. Level term life insurance policy is generally much more costly than lowering term life insurance coverage, where the survivor benefit lowers over time. Other than the sort of policy you have, there are numerous other variables that help figure out the expense of life insurance: Older candidates normally have a higher death danger, so they are generally a lot more costly to insure.

On the flip side, you might be able to safeguard a less expensive life insurance policy price if you open the plan when you're more youthful. Comparable to sophisticated age, poor health can additionally make you a riskier (and extra expensive) candidate for life insurance. If the condition is well-managed, you might still be able to find budget-friendly protection.

What is Short Term Life Insurance Coverage Like?

Health and age are typically a lot more impactful premium aspects than gender., might lead you to pay more for life insurance. Risky tasks, like home window cleansing or tree trimming, may additionally drive up your price of life insurance coverage.

The initial action is to establish what you need the plan for and what your spending plan is. Some firms provide on-line pricing estimate for life insurance policy, but many require you to call an agent over the phone or in individual.

1Term life insurance policy provides momentary protection for a vital period of time and is generally more economical than long-term life insurance. 2Term conversion standards and limitations, such as timing, might use; for instance, there might be a ten-year conversion opportunity for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance policy Acquisition Option in New York City. 4Not available in every state. There is an expense to exercise this cyclist. Products and bikers are readily available in accepted territories and names and features may vary. 5Dividends are not guaranteed. Not all taking part policy proprietors are eligible for dividends. For choose bikers, the condition uses to the insured.

Our term life alternatives consist of 10, 15, 20, 25, 30, 35, and 40-year policies. The most popular kind is level term, implying your payment (premium) and payment (survivor benefit) remains degree, or the same, till completion of the term duration. Direct term life insurance meaning. This is one of the most straightforward of life insurance policy alternatives and needs extremely little maintenance for policy proprietors

You could give 50% to your spouse and split the rest amongst your adult youngsters, a parent, a pal, or also a charity. * In some circumstances the survivor benefit might not be tax-free, discover when life insurance policy is taxable.

Is Guaranteed Level Term Life Insurance a Good Option for You?

There is no payout if the plan expires before your death or you live beyond the policy term. You may be able to renew a term plan at expiry, but the premiums will be recalculated based on your age at the time of revival.

At age 50, the costs would climb to $67 a month. Term Life Insurance coverage Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life policy, for men and women in exceptional health and wellness.

Interest rates, the financials of the insurance coverage company, and state policies can likewise impact premiums. When you think about the amount of insurance coverage you can get for your premium dollars, term life insurance policy has a tendency to be the least costly life insurance coverage.

Table of Contents

Latest Posts

Highlighting Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining Fixed Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing th

Final Expense Florida

How To Sell Burial Insurance

More

Latest Posts

Final Expense Florida

How To Sell Burial Insurance