All Categories

Featured

Table of Contents

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. life insurance for estate planning with brokers. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

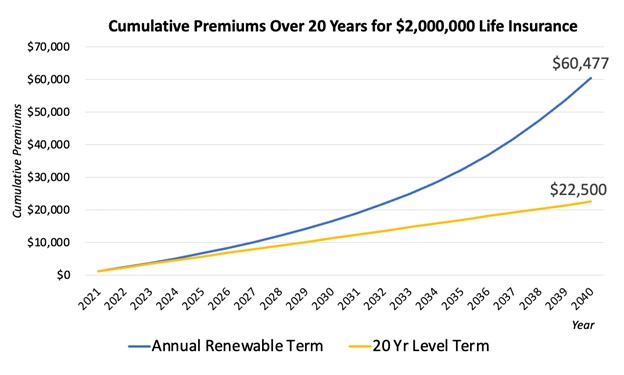

They commonly provide an amount of protection for much less than irreversible kinds of life insurance policy. Like any plan, term life insurance has benefits and drawbacks depending on what will certainly work best for you. The benefits of term life consist of affordability and the capability to customize your term size and coverage quantity based upon your demands.

Depending on the type of plan, term life can supply fixed premiums for the whole term or life insurance policy on level terms. The fatality benefits can be repaired.

Value Decreasing Term Life Insurance

You ought to consult your tax consultants for your specific accurate situation. Fees reflect plans in the Preferred Plus Price Course concerns by American General 5 Stars My representative was extremely well-informed and helpful while doing so. No pressure to purchase and the procedure fasted. July 13, 2023 5 Stars I was satisfied that all my requirements were satisfied quickly and expertly by all the representatives I spoke with.

All paperwork was electronically finished with accessibility to downloading and install for personal data upkeep. June 19, 2023 The endorsements/testimonials provided need to not be construed as a suggestion to acquire, or an indicator of the worth of any type of product and services. The endorsements are real Corebridge Direct consumers that are not associated with Corebridge Direct and were not given compensation.

2 Price of insurance prices are determined utilizing methodologies that vary by company. It's important to look at all aspects when reviewing the overall competitiveness of prices and the value of life insurance policy protection.

Term Vs Universal Life Insurance

Like most team insurance policy policies, insurance plans offered by MetLife consist of particular exclusions, exemptions, waiting durations, decreases, limitations and terms for keeping them in pressure (level term life insurance). Please call your benefits manager or MetLife for costs and full details.

For the most component, there are two types of life insurance policy plans - either term or long-term plans or some mix of the 2. Life insurance companies use different types of term strategies and typical life policies as well as "rate of interest delicate" items which have actually become more widespread since the 1980's.

Term insurance coverage gives security for a specific period of time. This period could be as short as one year or supply coverage for a particular number of years such as 5, 10, 20 years or to a defined age such as 80 or in some situations approximately the earliest age in the life insurance policy mortality.

Proven A Term Life Insurance Policy Matures

Currently term insurance coverage rates are extremely competitive and amongst the cheapest historically experienced. It must be noted that it is a widely held idea that term insurance is the least expensive pure life insurance coverage available. One requires to assess the plan terms thoroughly to determine which term life alternatives are suitable to meet your particular conditions.

With each new term the premium is increased. The right to restore the policy without evidence of insurability is a vital benefit to you. Or else, the threat you take is that your wellness might wear away and you may be unable to acquire a policy at the exact same prices or perhaps whatsoever, leaving you and your beneficiaries without insurance coverage.

You must exercise this option during the conversion period. The size of the conversion period will certainly differ depending upon the kind of term policy bought. If you transform within the prescribed period, you are not called for to provide any information concerning your health. The premium rate you pay on conversion is typically based on your "present achieved age", which is your age on the conversion day.

Under a degree term plan the face amount of the plan remains the same for the entire duration. Frequently such policies are sold as home loan security with the quantity of insurance coverage lowering as the equilibrium of the mortgage reduces.

Commonly, insurance providers have not deserved to transform premiums after the policy is sold (term life insurance with accelerated death benefit). Since such policies may proceed for several years, insurance companies have to use conservative mortality, rate of interest and cost rate quotes in the premium calculation. Adjustable premium insurance policy, however, allows insurance firms to use insurance at reduced "current" premiums based upon much less conventional assumptions with the right to alter these costs in the future

Joint Term Life Insurance

While term insurance coverage is created to offer protection for a specified period, long-term insurance policy is developed to give protection for your whole lifetime. To maintain the costs price degree, the costs at the younger ages goes beyond the actual cost of protection. This added premium builds a book (cash value) which assists pay for the policy in later years as the price of security increases over the costs.

The insurance coverage business invests the excess costs bucks This kind of policy, which is often called cash money value life insurance coverage, produces a savings component. Cash money worths are crucial to a permanent life insurance coverage plan.

Expert What Is Voluntary Term Life Insurance

In some cases, there is no connection between the dimension of the cash worth and the costs paid. It is the cash value of the policy that can be accessed while the policyholder is alive. The Commissioners 1980 Requirement Ordinary Death Table (CSO) is the current table utilized in determining minimum nonforfeiture values and plan gets for average life insurance policy policies.

There are 2 standard groups of permanent insurance, traditional and interest-sensitive, each with a number of variants. Conventional whole life policies are based upon long-lasting quotes of expense, rate of interest and death (decreasing term life insurance).

If these quotes change in later years, the business will readjust the premium accordingly yet never above the maximum assured costs mentioned in the plan. An economatic entire life policy attends to a fundamental amount of taking part entire life insurance policy with an extra supplemental insurance coverage given through using rewards.

Because the costs are paid over a much shorter span of time, the premium repayments will be more than under the whole life plan. Single costs entire life is minimal payment life where one large superior payment is made. The policy is fully compensated and no further costs are needed.

Table of Contents

Latest Posts

Highlighting Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining Fixed Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing th

Final Expense Florida

How To Sell Burial Insurance

More

Latest Posts

Final Expense Florida

How To Sell Burial Insurance