All Categories

Featured

Table of Contents

If George is diagnosed with a terminal ailment during the initial policy term, he most likely will not be eligible to renew the policy when it expires. Some plans supply ensured re-insurability (without proof of insurability), however such functions come with a higher cost. There are numerous kinds of term life insurance.

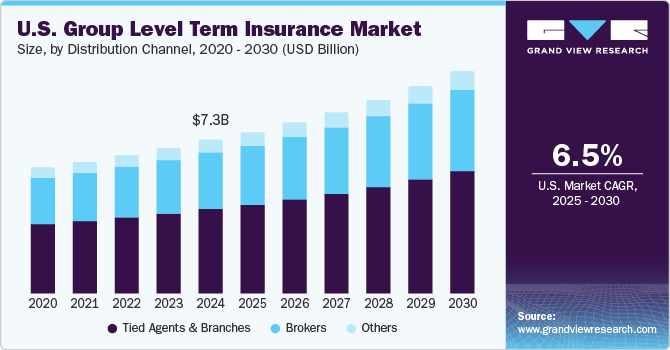

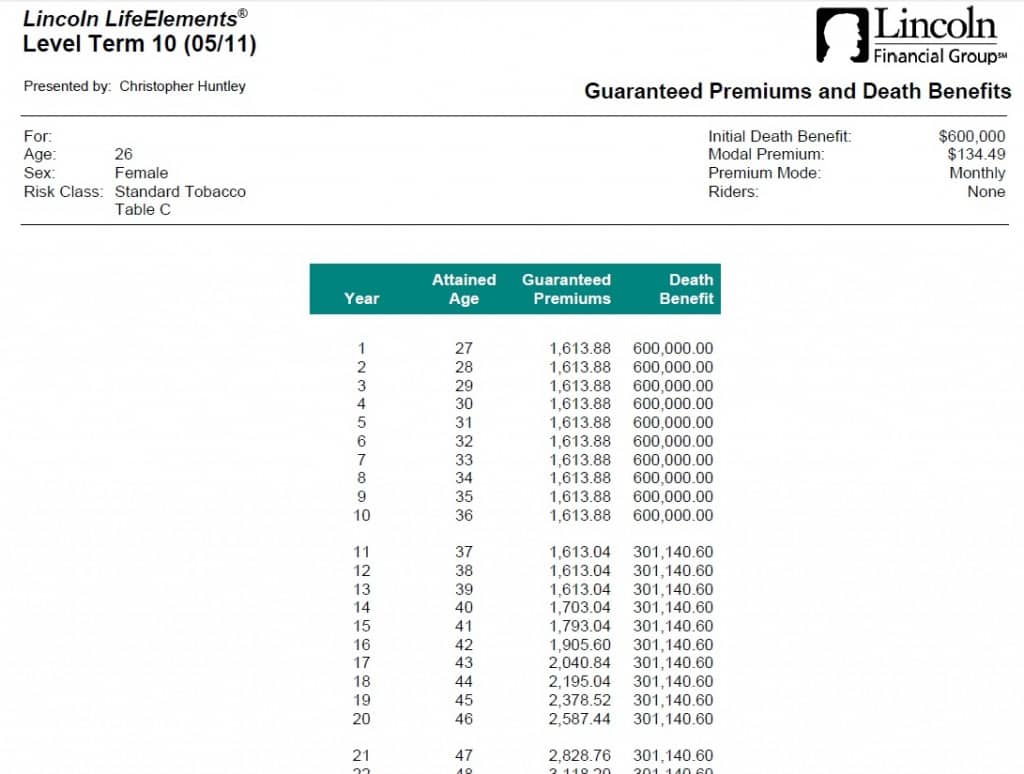

Generally, most business supply terms varying from 10 to thirty years, although a couple of deal 35- and 40-year terms. Level-premium insurance policy has a set month-to-month settlement for the life of the policy. A lot of term life insurance coverage has a level premium, and it's the type we have actually been referring to in a lot of this short article.

Term life insurance coverage is eye-catching to youngsters with youngsters. Parents can obtain substantial protection for an affordable, and if the insured dies while the plan is in result, the family can depend on the survivor benefit to change lost revenue. These plans are additionally appropriate for individuals with expanding families.

How Increasing Term Life Insurance Can Secure Your Future

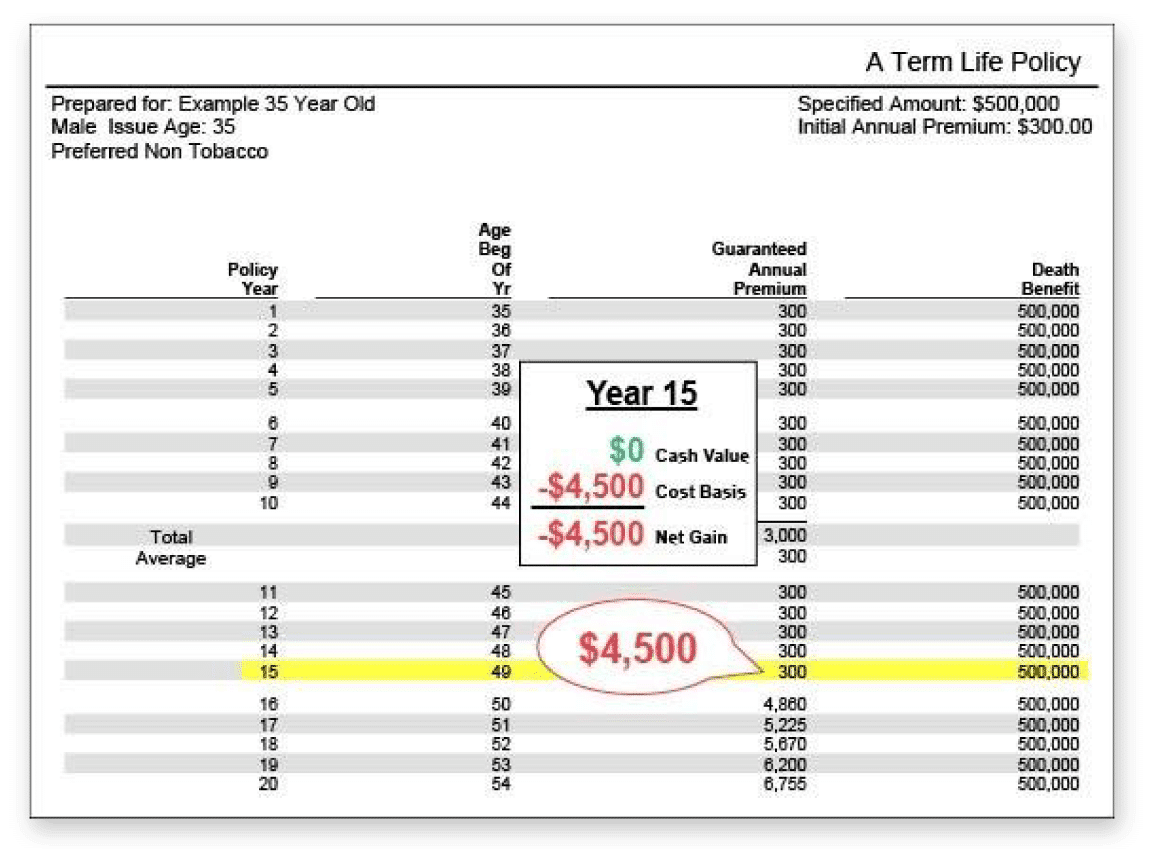

The appropriate choice for you will rely on your needs. Right here are some points to think about. Term life plans are perfect for people who want significant protection at a reduced cost. People that own entire life insurance coverage pay a lot more in costs for much less insurance coverage however have the protection of understanding they are safeguarded permanently.

The conversion biker ought to allow you to transform to any kind of long-term plan the insurer uses without restrictions. The key functions of the cyclist are keeping the original health and wellness rating of the term policy upon conversion (also if you later on have health concerns or become uninsurable) and deciding when and how much of the coverage to convert.

Of training course, general premiums will certainly raise dramatically considering that entire life insurance coverage is extra expensive than term life insurance coverage. Medical problems that develop throughout the term life period can not create premiums to be raised.

Understanding the Benefits of 20-year Level Term Life Insurance

Whole life insurance policy comes with significantly greater monthly costs. It is indicated to provide coverage for as long as you live.

It relies on their age. Insurer established an optimum age limit for term life insurance plans. This is usually 80 to 90 years old yet may be higher or reduced depending upon the firm. The costs likewise increases with age, so an individual aged 60 or 70 will certainly pay considerably more than someone decades younger.

Term life is rather comparable to vehicle insurance policy. It's statistically unlikely that you'll require it, and the premiums are cash down the tubes if you do not. If the worst occurs, your family will get the advantages.

What is Term Life Insurance Coverage Like?

Generally, there are two sorts of life insurance policy plans - either term or long-term strategies or some combination of the two. Life insurance firms provide various forms of term strategies and standard life plans along with "interest delicate" items which have actually come to be more common given that the 1980's.

Term insurance gives protection for a specified time period. This period might be as short as one year or provide coverage for a certain number of years such as 5, 10, two decades or to a defined age such as 80 or in some cases as much as the earliest age in the life insurance policy death tables.

What is Term Life Insurance For Seniors? What You Need to Know?

Currently term insurance rates are very competitive and among the least expensive traditionally experienced. It needs to be noted that it is a commonly held belief that term insurance is the least costly pure life insurance policy coverage readily available. One requires to evaluate the policy terms carefully to decide which term life choices are appropriate to fulfill your specific situations.

With each new term the premium is enhanced. The right to renew the plan without evidence of insurability is an essential advantage to you. Or else, the risk you take is that your health might weaken and you may be unable to acquire a policy at the same rates or even whatsoever, leaving you and your beneficiaries without insurance coverage.

You need to exercise this option throughout the conversion period. The size of the conversion period will certainly differ relying on the sort of term policy purchased. If you convert within the recommended duration, you are not needed to offer any details about your wellness. The premium price you pay on conversion is normally based upon your "existing achieved age", which is your age on the conversion date.

Under a level term policy the face quantity of the plan stays the same for the entire duration. Frequently such policies are marketed as home loan defense with the quantity of insurance coverage decreasing as the equilibrium of the home mortgage lowers.

Generally, insurance companies have not deserved to transform costs after the policy is sold. Because such plans might continue for several years, insurance companies must utilize traditional death, interest and expense price price quotes in the costs estimation. Adjustable premium insurance, nonetheless, enables insurance companies to offer insurance at lower "present" costs based upon less traditional presumptions with the right to alter these premiums in the future.

What Exactly Is 10-year Level Term Life Insurance Coverage?

While term insurance policy is created to supply protection for a specified time duration, permanent insurance is designed to give protection for your whole life time. To maintain the costs price level, the premium at the younger ages exceeds the real expense of protection. This added costs builds a reserve (cash money worth) which helps pay for the policy in later years as the expense of security rises above the premium.

The insurance policy company invests the excess premium bucks This kind of plan, which is often called cash worth life insurance coverage, generates a financial savings component. Money values are crucial to a long-term life insurance coverage plan.

Sometimes, there is no relationship in between the size of the cash value and the premiums paid. It is the cash money value of the plan that can be accessed while the policyholder is active. The Commissioners 1980 Standard Ordinary Mortality (CSO) is the current table utilized in determining minimum nonforfeiture values and plan reserves for normal life insurance policy policies.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (instant online life insurance quotes with agents). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

What Are the Benefits of Life Insurance?

Several long-term policies will have arrangements, which specify these tax requirements. Traditional entire life plans are based upon long-lasting price quotes of cost, interest and death.

Table of Contents

Latest Posts

Highlighting Fixed Interest Annuity Vs Variable Investment Annuity Key Insights on Your Financial Future Defining Fixed Annuity Vs Variable Annuity Features of Smart Investment Choices Why Choosing th

Final Expense Florida

How To Sell Burial Insurance

More

Latest Posts

Final Expense Florida

How To Sell Burial Insurance