All Categories

Featured

Table of Contents

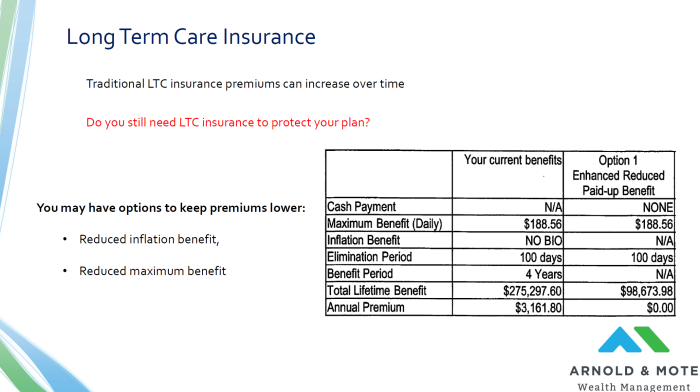

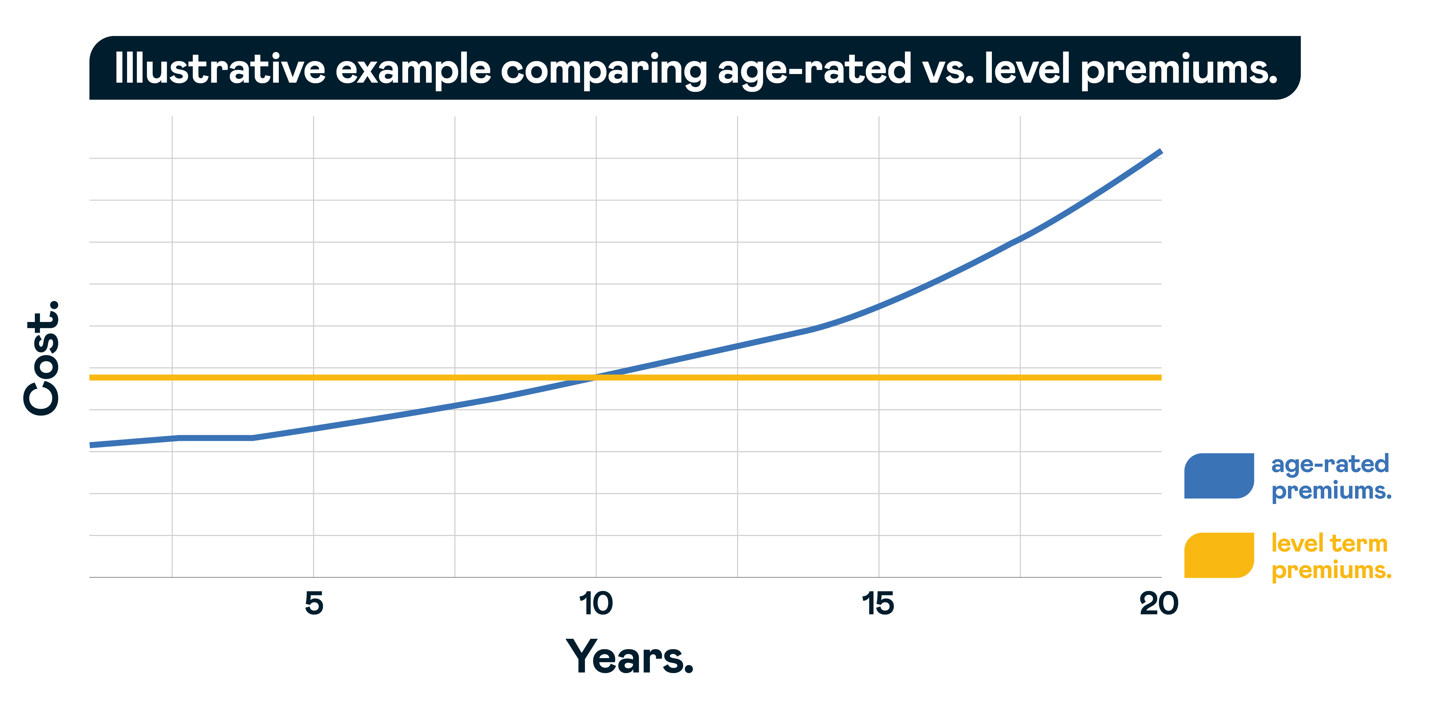

A degree term life insurance policy plan can give you assurance that individuals that depend on you will have a survivor benefit throughout the years that you are intending to sustain them. It's a way to aid look after them in the future, today. A level term life insurance policy (in some cases called degree premium term life insurance policy) policy supplies protection for an established number of years (e.g., 10 or two decades) while maintaining the premium settlements the very same for the duration of the plan.

With level term insurance policy, the price of the insurance will stay the exact same (or potentially lower if rewards are paid) over the term of your policy, typically 10 or 20 years. Unlike permanent life insurance policy, which never expires as long as you pay costs, a degree term life insurance policy policy will certainly end at some factor in the future, commonly at the end of the period of your level term.

What Is Term Life Insurance For Couples Coverage and How Does It Work?

Since of this, many individuals use permanent insurance policy as a secure monetary preparation device that can offer many needs. You might have the ability to convert some, or all, of your term insurance policy during a set duration, usually the initial 10 years of your policy, without needing to re-qualify for insurance coverage even if your health has transformed.

As it does, you may desire to include to your insurance policy protection in the future - Level benefit term life insurance. As this occurs, you might want to ultimately lower your fatality benefit or think about transforming your term insurance to a long-term plan.

So long as you pay your premiums, you can relax very easy recognizing that your liked ones will certainly obtain a survivor benefit if you die during the term. Numerous term policies enable you the capability to convert to long-term insurance without needing to take another health exam. This can enable you to make the most of the fringe benefits of a permanent plan.

Level term life insurance policy is among the easiest paths into life insurance, we'll discuss the benefits and drawbacks to make sure that you can pick a plan to fit your needs. Degree term life insurance policy is one of the most usual and standard type of term life. When you're seeking momentary life insurance policy strategies, degree term life insurance is one route that you can go.

The application process for degree term life insurance policy is typically really uncomplicated. You'll fill in an application that includes general individual information such as your name, age, and so on in addition to a more comprehensive survey regarding your case history. Depending upon the plan you want, you might have to take part in a medical exam process.

The brief answer is no., for instance, let you have the convenience of death benefits and can accumulate cash money worth over time, indicating you'll have much more control over your advantages while you're alive.

The Ultimate Guide: What is Level Term Life Insurance Definition?

Bikers are optional stipulations contributed to your policy that can offer you additional benefits and defenses. Cyclists are a wonderful way to add safeguards to your plan. Anything can happen over the training course of your life insurance coverage term, and you intend to await anything. By paying just a bit much more a month, cyclists can offer the assistance you require in instance of an emergency.

There are circumstances where these advantages are built right into your policy, however they can likewise be offered as a different enhancement that requires extra repayment.

Latest Posts

Are Index-linked Annuities death benefits taxable

Quality What Is Direct Term Life Insurance

Life Insurance For Home